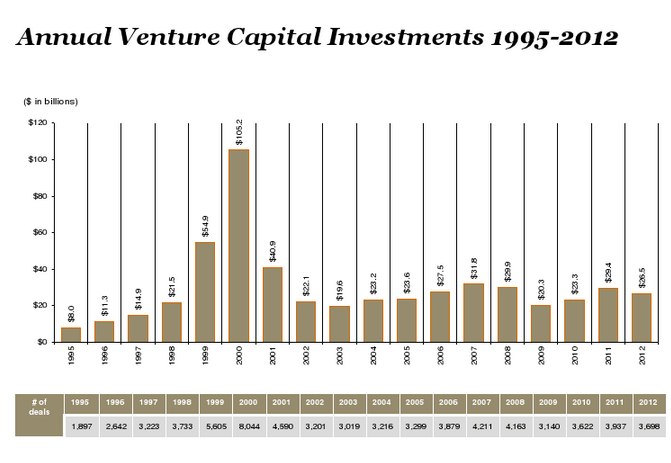

A new Moneytree report is being released this evening, showing that annual VC investment dollars have declined for the first time in three years. The study, which was conducted by PricewaterhouseCoopers and the National Venture Capital Association (NVCA), and based on data from Thomson Reuters, reports that there were $26.5 billion put into 3,698 VC deals in 2012, a decrease of 10 percent in dollars and a 6 percent decline in deals over the prior year.

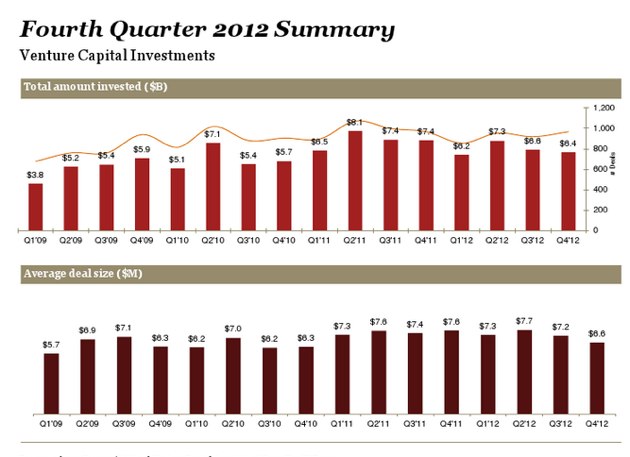

For the fourth quarter, venture investment of $6.4 billion into 968 companies fell 3 percent in dollars, but rose 5 percent in deal volume over Q3 2012. While the numbers differ slightly, this data is in line with a similar report released earlier this week from CB Insights.

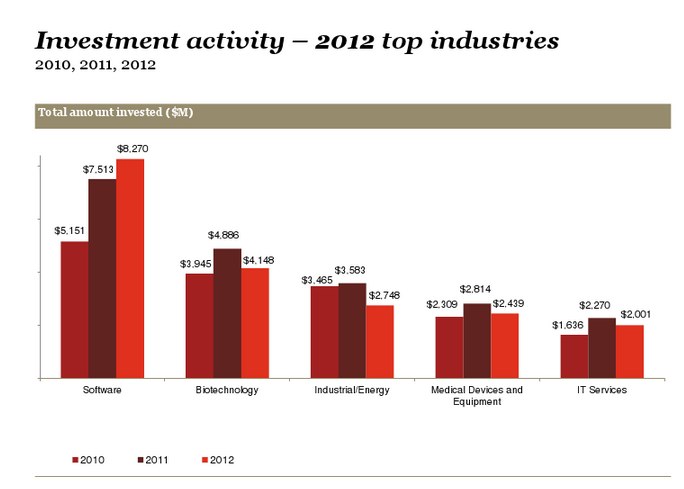

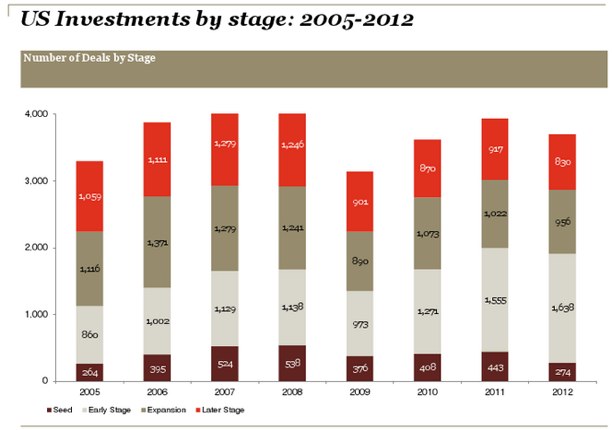

Most industries saw double-digit decreases in investment dollars, especially the Clean Technology and Life Sciences sectors. However, the software sector actually saw an increase this year in dollars invested. Additionally, stage of investment shifted from Seed to Early Stage in 2012 as venture capitalists overall began engaging with companies later in their life cycle than in previous years.

“General economic uncertainty continues to hinder capital investments, and venture capitalists are no different,” noted Tracy T. Lefteroff, global managing partner of the venture capital practice at PwC U.S., in the report.

“As some expected, 2012 investment levels are less than what we saw in 2011. And, we’ve seen nearly a third fewer dollars going into even less Seed Stage companies during that same time. As the number of new funds being raised continues to shrink, venture capitalists are being more discriminating with where they’re willing to place new bets. At the same time, they’re holding on to reserves to continue to support the companies already in their portfolio. Both of these factors are taking a toll on the amount of capital available for young start-ups, which is reflected in the 38 percent drop in the number of Seed Stage companies receiving VC dollars in 2012.”

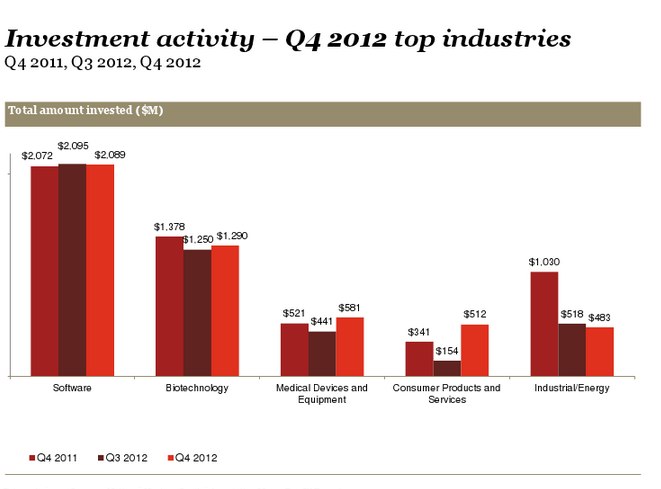

As we mentioned, the Software industry maintained its status as the largest investment sector for the year, with dollars rising 10 percent over 2011 to $8.3 billion, which was invested into 1,266 deals, an 8 percent rise in volume over the prior year. This represented the highest level of investment in the Software sector since 2001.

Investment in the fourth quarter of 2012 remained flat in dollars but increased 17 percent in deals from Q3 with $2.1 billion going into 368 companies. Software was also the No. 1 sector in Q4 for dollars invested and number of deals.

Internet-specific companies experienced a 5 percent decline in both dollars and deals for the full year 2012, with $6.7 billion going into 976 rounds compared to 2011 when $7.1 billion went into 1,033 deals. Interestingly, this year marked the second highest level of Internet investment since 2001.

For the fourth quarter, Internet-specific investment declined 13 percent in dollars and 5 percent in deals, with $1.5 billion going into 242 deals, compared to $1.7 billion going into 255 deals in the third quarter of 2012. Internet companies accounted for 25 percent of all venture capital dollars in 2012, up from 24 percent in 2011.

Biotechnology investment dollars declined 15 percent with volume flat in 2012 to $4.1 billion going into 466 deals, placing it as the second largest investment sector for the year in terms of dollars and deals. The Medical Device industry fell 13 percent in dollars and 15 percent in deals in 2012, finishing the year with $2.4 billion going into 313 deals.

The Clean Technology sector experienced a 28 percent decrease in dollars and a 23 percent decline in deal volume in 2012, bringing the year’s total to $3.3 billion going into 267 deals, compared to $4.6 billion going into 348 deals in 2011.

In terms of stage, investments into Seed Stage companies decreased 31 percent in terms of dollars and 38 percent in deals with $725 million going into 274 companies in 2012, the lowest annual seed dollars since 2003. This is interesting considering the CB insights report said that Seed deals experienced a high in terms of deals and dollars. The difference in data may be attributed to the Moneytree report only calculating VC firms, and not integrating seed deals from individual investors.

For the fourth quarter, VCs invested $156 million into 67 seed stage companies, the lowest quarterly dollar investment since 2005. Seed Stage companies attracted 3 percent of dollars and 7 percent of deals in 2012, compared to 4 percent of dollars and 11 percent of deals in 2011. The average seed-stage round in 2012 was $2.6 million up from $2.4 million in 2011.

Early Stage investments experienced an 11 percent decline in dollars but a 5 percent increase in deal volume in 2012 with $7.8 billion going into 1,638 deals. For the fourth quarter, Early Stage investments increased 5 percent in dollars and 9 percent in deals over Q3 2012 with $1.9 billion going into 448 companies. Early Stage companies attracted 30 percent of dollars and 44 percent of deals in 2012 compared to 30 percent of dollars and 39 percent of deals in 2011. The average Early Stage deal in 2012 was $4.8 billion down from $5.6 billion in 2011.

Expansion Stage investments decreased in 2012 by 5 percent in dollars and dropped 6 percent in deals, with $9.4 billion going into 956 deals. Expansion funding also dropped in the fourth quarter, dipping 14 percent from the prior quarter to $2.2 billion. The number of deals also decreased during the quarter, falling 2 percent to 240. Expansion Stage companies attracted 35 percent of dollars and 26 percent of deals in 2012 compared to 33 percent of dollars and 26 percent of deals in 2011. The average Expansion Stage deal size in 2012 was $9.8 billion compared to $9.6 billion in 2011.

In 2012, $8.6 billion was invested into 830 Later Stage deals, a 12 percent decrease in dollars and a 9-percent decrease in deals for the year. For the fourth quarter, $2.1 billion went into 213 deals, which represents a 5 percent increase in dollars and a 10 percent rise in deals from the third quarter of 2012. Later Stage companies attracted 32 percent of dollars and 22 percent of deals in 2012 compared to 33 percent of dollars and 23 percent of deals in 2011. The average size of a Later Stage deal fell slightly from $10.7 billion in 2011 to $10.4 billion in 2012.

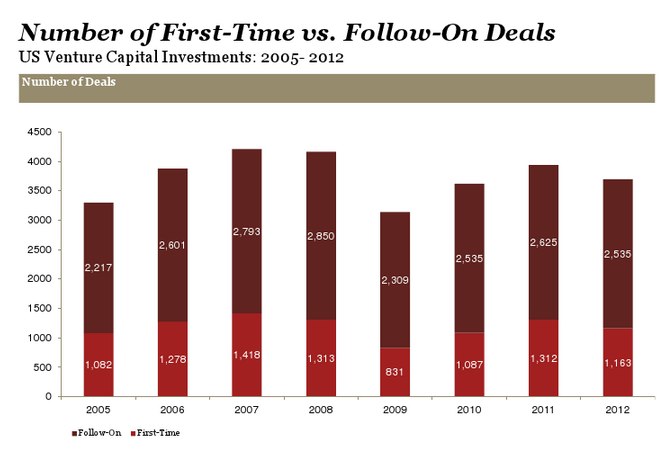

First-time financings fell both in terms of dollars and deals from the prior year, declining to $4.1 billion going into 1,163 companies, a 24 percent decrease in dollars and an 11 percent decrease in deals. However, the dollar level and number of companies receiving venture capital for the first time remained relatively flat in Q4 compared to the third quarter, with $1.1 billion going into 306 companies. First-time financings accounted for 16 percent of dollars and 31 percent of deals in 2012 compared to 18 percent of dollars and 33 percent of deals in 2011.

Industries receiving the most dollars in first-time financings in 2012 were Software, Media/Entertainment and Biotechnology. Industries with the most first-time deals in 2012 were Software, Media/Entertainment, and IT Services. Sixty-five percent of first-time deals in 2012 were in the Early Stage of development followed by the Seed Stage of development at 17 percent, Expansion Stage companies at 12 percent and Later Stage companies at 7 percent.

Source: www.techcrunch.com

No comments:

Post a Comment